Finance Track

If you’re looking for an MBA program that will help you excel in the finance industry, Simon Business School needs to be on your short list. Our unique STEM-designated option signals the MBA program’s analytical rigor to future employers and grants international students the opportunity to extend Optional Practical Training (OPT).

Jump-start your career at Simon, one of the country's best MBAs with a finance specialization.

The numbers speak for themselves. Our graduates often go on to work in—and lead—investment firms, multinational banks, and corporate finance departments of Fortune 100 companies.

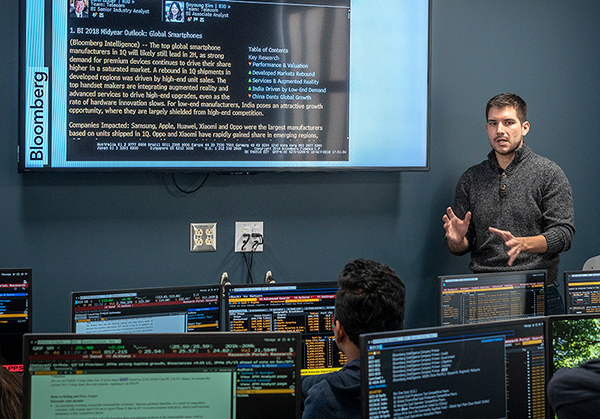

Why? Because Simon Business School helps prepare students to succeed in finance careers through our Integrated Student Experience which connects project-based coursework, co-curricular learning opportunities, and engaging career activities into one immersive finance-focused MBA.

Learn from experts who originated the research.

Simon MBAs focusing in finance study with finance professors who are not only elective teachers and dedicated mentors, but who are renowned scholars who wrote the books on modern financial concepts—literally. We’re the birthplace of Positive Accounting Theory, among others, and three of the industry’s preeminent journals were either founded or edited at Simon:

• Journal of Accounting and Economics

• Journal of Monetary Economics

Through the course of your program, you’ll learn state-of-the-art techniques for financial analysis. You’ll learn how to solve important corporate finance challenges and formulate conclusions based on the industry’s many databases and financial market indicators.

Career-ready MBA finance specializations.

You can choose from four specializations in our MBA finance track: asset management, banking, corporate finance, and venture capital & private equity. Each finance specialization dives deeper into one aspect of finance and has an option to graduate with STEM designation. Alongside our specializations, we offer 10 MBA minors to build out your skills in a particular area. Our curriculum is designed to provide a solid foundation in business that is flexible enough to help you meet your unique career goals.

Click the specializations below to see required courses, which you’ll take in addition to Simon’s core MBA curriculum and electives.

|

|

|

|

Asset Management

Asset Management

The MBA specialization in asset management explores investment models, economic analysis, and asset management strategy.

Click each tile below for a brief course description.

Required Courses

FIN 411

FIN 411

ACC 411

ACC 411

FIN 424

FIN 424

FIN 434

FIN 434

Choose three electives

FIN 442

FIN 442

BPP 426

BPP 426

FIN 418

FIN 418

FIN 441A

FIN 441A

FIN 448

FIN 448

Banking

Banking

The MBA specialization in banking examines financial policy and systems alongside applied economic analysis.

Click each tile below for a brief course description.

Required Courses

FIN411

FIN411

FIN413

FIN413

ACC411

ACC411

FIN430

FIN430

Choose three electives

ACC 423

ACC 423

ACC 424

ACC 424

BPP 426

BPP 426

FIN 424

FIN 424

FIN 433

FIN 433

FIN/CIS 446

FIN/CIS 446

FIN 448

FIN 448

Corporate Finance

Corporate Finance

The MBA specialization in corporate finance offers a deep understanding of corporate financial policy, taxation, and strategic decision making.

Click each tile below for a brief course description.

Required Courses

FIN 411

FIN 411

FIN413

FIN413

ACC411

ACC411

ACC410

ACC410

FIN433

FIN433

Choose three electives

ACC418

ACC418

ACC423

ACC423

ACC424

ACC424

FIN442

FIN442

FIN424

FIN424

STR440

STR440

Venture Capital & Private Equity

Venture Capital & Private Equity

The MBA specialization in Venture Capital provides fundamental knowledge in corporate and entrepreneurial finance strategy, venture development, and financial technology.

Click each tile below for a brief course description.