Short selling

Short selling

October 5, 2022 | By Christian Opp

Short selling in financial markets regularly attracts the attention of investors and regulators, especially during booms and busts. Below, I take a closer look at how it all works and how savvy investors can benefit from lending shares to short sellers.

How does short selling work?

Shorting a stock is a bit more involved than buying a stock. It consists of a two-step transaction whereby an investor, like a hedge fund, first borrows the shares from a lender (for example Fidelity or Vanguard) and then immediately sells these borrowed shares to other traders in the stock market. As a result, the hedge fund obtains cash from the sale, but it has a liability to re-deliver the borrowed shares to the lender in the future. Given the negative outlook that the hedge fund has for the stock, it expects to be able to repurchase the shares at a lower price in the future, thus making a profit overall. However, the hedge fund also must pay fees to the lender. In practice, these fees can vary dramatically across stocks and over time. For example, for Meme stocks such as GameStop, loan fees have at times exceeded 100% per annum in recent months, which made it increasingly difficult for hedge funds to bet against these stocks.

How can short selling benefit investors?

The fact that short sellers must pay fees to stock lenders is often overlooked. In recent work with Ron Kaniel (Simon) and Shuaiyu Chen (PhD 21’, now at Purdue) I investigate the determinants of these stock loan fees and how much lenders can benefit from them. Our results suggest that investors can substantially increase the value of their portfolio when participating in stock lending, especially when they are invested in small companies.

What determines stock loan fees?

The securities lending market is highly concentrated, meaning that it is dominated by a few large financial institutions that act as so-called custodian lenders. These custodian lenders administer mutual funds and ETFs for regular investors and lend out shares that are part of their funds’ portfolios. Lending shares is effectively delegated to a small set of intermediaries that have to be contacted bilaterally to implement a short position.

For a given stock, the top two security lenders typically command a large market share, often ranging between 35% and 55%. Consistent with the idea that these lenders have market power, fees on lending contracts are elevated and non-competitive across the whole universe of publicly traded stocks. Fees typically range between 0.3% per annum for the group of stocks with the highest market capitalization and lowest fees and 75% for the smallest, highest-fee stocks. At times, as in the case of GameStop, they can be even higher.

Why is the securities lending market subject to market power?

To understand why the securities lending market is subject to market power, it is important to recognize the two-step nature of short sales transactions. Since traders have to borrow securities before they can sell them in the stock market, they are concerned about information leakages. If other market participants could immediately observe their borrowing demand, prices in the stock market would decline before they could actually sell the borrowed securities. In other words, information leakages would impede traders' ability to profit from shorting. Short sellers therefore benefit from an intransparent securities lending market, which is achieved by the existing concentrated and delegated market structure. This market structure is also in the interest of shares lenders, who can extract a fraction of short sellers trading profits via stock loan fees.

How much do lenders stand to gain?

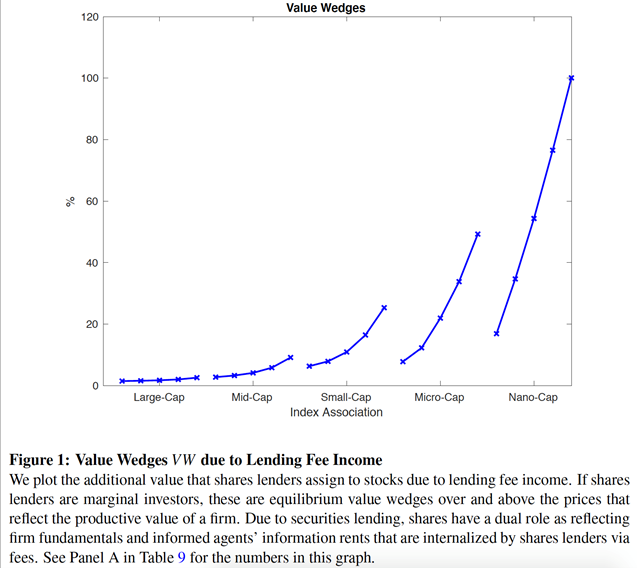

In our analysis, we quantify how much added value participating security lenders obtain from the loan fees they collect. We find that shares lenders obtain an incremental present value ranging from 1.5% for large-cap, low-fee stocks to 25% for small-cap stocks, and even more than 100% for nano-cap stocks. Figure 1 illustrates these value wedges.

These results also suggest that loan fees can have substantial impact on prices in stock markets: Investors that plan to lend out their small-cap stocks may be willing to pay significantly more for the shares, thereby affecting prices. On the other hand, our results indicate that those investors currently not participating in shares lending potentially leave a lot of value on the table. These investors would do well contacting their brokers to obtain information about their opportunities to lend out the shares in their portfolio.

The bottom line.

Short selling can not only benefit sophisticated traders like hedge funds but also add substantial value for long-term investors participating in shares lending, especially for those invested in smaller companies.

Christian Opp is an associate professor of finance at Simon Business School. His work analyzes financial institutions’ and markets’ impact on allocations, with a particular focus on the role of informational frictions.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education. To view other blogs in this series, visit the Dean's Corner Main Page.