How DOGE is Dodging the Real Issue

How DOGE is Dodging the Real Issue

March, 17 2025 | By Sevin Yeltekin

From ambitious budget cuts to sweeping deregulation, the newly formed Department of Government Efficiency (DOGE) has sparked heated debate about its true objectives. Is it a well-intentioned effort to streamline bureaucracy, or a Trojan horse for drastic downsizing and privatization? In this Q&A, I speak with Joseph Kalmenovitz, assistant professor of finance at Simon, to unpack the implications of DOGE’s evolving role, the challenges of implementing its proposed changes, and the broader impact on businesses, government agencies, and the economy at large.

Dean Sevin Yeltekin: As an advisory commission rather than a department, what power will the newly formed Department of Government Efficiency (DOGE) have?

Joseph Kalmenovitz: DOGE was supposed to operate outside of the federal government, in an informal advisory role (which is different from a formal advisory board that is created and regulated via a separate process). In a clever move, DOGE merged with an existing unit within the White House. DOGE is now part of the government, and some of its staff are on the federal payroll. This gives DOGE two key advantages:

First, DOGE can now have easy access to the nerve centers of the federal government, assuming federal courts do not intervene. They can gain key insights into federal agency operations. The federal bureaucracy is vast and complex, and to make a serious attempt at shrinking it, one must first have a solid understanding of how it functions. With access to this crucial information, DOGE can be in a better position to devise concrete plans based on solid intel and a deep institutional knowledge.

Second, working from the inside grants DOGE direct access to where the real power centers, especially the Office of Management and Budget (OMB), which oversees the government’s regulatory agenda, and the Office of Personnel Management, which oversees the federal workforce. DOGE may not have formal authority to change the bureaucracy, and asking for this authority would be a tough battle that would take time and resources. However, they did receive direct access to government units that already have those powers. This would increase the chances that DOGE would be able to implement any big changes they plan.

SY: The DOGE commission has mentioned eliminating several federal agencies and even entire Departments of the US government, what role will this play in regulation of businesses under the Trump administration?

JK: The term “government efficiency”, the “GE” in “DOGE”, is a brilliant marketing tactic: it uses a harmless term to mask a massive deregulatory attempt. DOGE seems to have two very different objectives. One is for the government to perform the same functions more efficiently, using fewer resources and have better outcomes. Another is to limit the functions of the government.

Can the government operate more efficiently? Likely yes—its vast size leaves plenty of room for improvement. For example, there must be at least a few obvious redundancies in the federal workforce. In theory, this should be a bipartisan goal. In reality, federal employees are unionized and do wield political influence. If efficiency is the goal, many other priorities should come before job cuts. Upgrading the government’s IT and technology seems like one obvious area, a process that has already started under the Biden administration. Government pay is another key area, with studies revealing surprising insights. For instance, pay-for-performance may not be such a good idea in the public sector, and leaving the revolving door open can have adverse incentive effect on current federal employees. This is a valuable area to explore with an open mind, but reforming the federal bureaucracy is serious. It impacts both workers and the economy.

I doubt DOGE relies on these "boring" efficiency gains. If I am allowed to speculate, I would guess its real aim is deregulation. I think this is a far more ambitious and risky goal, and maybe that’s why DOGE prefers to hide behind the “efficiency” flag. Consider, for example, the idea to eliminate entire agencies or departments. Suppose we shut down the Federal Aviation Administration. Who would man the control towers? Who would inspect the safety of airplanes? Who will prevent the next fatal crash at our nation’s airports? If the answer is “nobody”, it means a massive deregulation with far-reaching consequences. To state the obvious, this will not only result in terrible human tragedies but also have huge implications for the economic activities as many people will not fly.

Is that really what we want? We need a serious, fact-based debate on the costs and benefits of regulations. But pushing for deregulatory effort under the pretext of “government efficiency,” and suggesting overly broad reforms like “shutting down Department X” without being clear about who will perform those duties, undermines the credibility of the entire process.

SY: Is it possible for Elon Musk to make good on his promise to reduce the federal budget by $2 Trillion, if so would this lead to more privatization of existing services provided by the federal workforce? For example, when Musk took over Twitter (now X) in 2022, he reduced the workforce from 8,000 to 1,500—an approximately 80% cut, according to his 2023 statements. Could similar drastic measures be applied to the federal government?

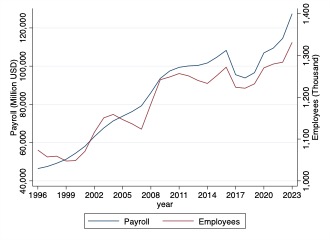

JK: A $2 trillion cut is ambitious, given a ~$6 trillion budget. They’ve likely scaled back their projections after learning more about federal operations. Even ignoring the downsides, the potential savings of cutting the federal workforce are not huge. As part of my academic research, I was able to obtain a unique dataset via many FOIA requests since 1996, and I continue to update it regularly. Here is one important figure that we need to keep in mind:

The number of federal employees trends upward with year-on-year fluctuations up to ±3%. In 2023, there were 1.33 million civilian federal employees (excluding the Department of Defense), and payroll expenses were $127.4 billion. Cutting redundancies is sensible, but savings will fall far short of trillions. We should adjust expectations on what is achievable here.

SY: Will the changes suggested by DOGE be subject to resistance from Congress, or can they be implemented via Executive Order?

JK: Congress will likely have limited formal input in many DOGE initiatives, especially smaller administrative changes like tech upgrades or workforce adjustments, which the Executive Branch can handle internally. However, more serious steps may require Congressional involvement. Any serious reform would require extra budget or at least reallocation of already appropriated funds, all of which is likely determined by Congress. Moreover, shutting down entire departments would require legislative changes, again by Congress.

By the way, I’m unsure what would happen if functions were simply absorbed into a larger unit, for instance, replacing the independent USAID with a “USAID Division” within the Department of State, but efficiency gains would likely be minimal.

It gets more interesting when we consider DOGE’s more ambitious goal: deregulation. This is because federal agencies, not Congress, set and adjust rules. While the White House and the Office of Management and Budget (OMB) which is part of the Executive branch, provides some coordination, agencies largely operate autonomously.

To achieve a meaningful deregulatory reform, DOGE and its allies would have to assert control over key federal agencies. This means appointing like-minded top officials at each agency, a difficult task since the Senate follows its own timetable and leaves many positions vacant for years. The bigger challenge is how those political appointees can mobilize the large bureaucracy to serve their deregulatory agenda. Career employees may resist a deregulatory agenda due to differing views or concerns about job security, leading to potential resignations or delays.

Perhaps this is why DOGE and its allies conflate efficiency with deregulation, and why they insist on being part of the government rather than installing an informal advisory body. By threatening to shut down departments and fire employees under the pretense of efficiency, they can gain leverage to implement more far-reaching objectives: taming the bureaucracy to achieve their deregulatory goals. The not-so-subtle message is, “get in line or get out.”

SY: Between the election on November 5, 2024, and the end of the year, the stock prices of companies that provide services to the government dropped by as much as 31% (according to Forbes’ Contributor Jerrold Lundquist). Should investors be worried these companies might lose business or face challenges because of changes the new administration may bring?

JK: This raises an important issue: uncertainty. This administration follows a familiar approach of replacing the prior administration's policies with new ones. We’ve discussed the policy details, but even proposing major changes creates significant uncertainty. It is not clear how serious the new administration is, what exactly those new policies will look like, and how broad and successful the implementation be. This uncertainty impacts households and firms alike, regardless of whether policies are effective or implemented. Here are two examples:

1) The new administration threatens to abolish the Department of Education, which oversees Federal Student Aid and all student loans. Millions of Americans carry student loans, often tens of thousands of dollars, and they are under tremendous pressure to make their monthly payments. Many likely don't understand the impact of shutting down the DOE and disrupting Federal Student Aid. What will happen to the loans? Can they continue payments? Will loans transfer to a new service with different protocols? While this uncertainty continues, major life decisions such as buying a new house or even raising a family are put on hold. This is just one example of how even the news of a policy change can immediately affect real people.

2) Another example is the deregulation itself. Here are two facts:

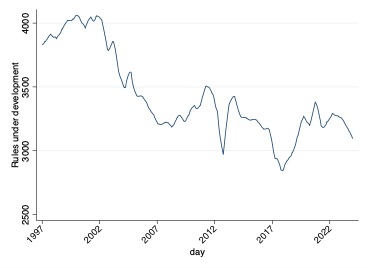

- First, writing a new regulation takes time, often 1.5-2 years on average, due to the lengthy process outlined in the Administrative Procedure Act. I explored this process with my coauthors in this paper. Because rule proposals take so long to develop, there is always a large pipeline of them in progress. In fact, my calculations show that in an average day, the federal government works on more than 3,300 rule proposals:

- Second, to cancel an existing regulation (“deregulation”), the government will typically have to follow the exact same deliberation process, meaning any proposal to eliminate a specific regulation would be added to the pipeline, taking several years to accomplish. This is a major source of uncertainty for companies. Not only do they have to comply with existing regulations, but they also must keep track of thousands of potential changes to those regulations. Like households, companies also dislike uncertainty and delay major investments—like new factories or hiring—until it's resolved. Ongoing deregulation talk fuels uncertainty, likely impacting businesses immediately.

The future of DOGE and its deregulatory agenda remains uncertain, but its strategy starts to come into focus: leveraging the language of “efficiency” to push for sweeping changes in government operations. Will these efforts lead to meaningful improvements or simply create more uncertainty? What is certain, is that businesses, households, and policymakers must prepare for a period of significant transition, where the true impact of these reforms will only become clear over time.

Joseph Kalmenovitz is an assistant professor of finance at Simon Business School.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education. To view other blogs in this series, visit the Dean's Corner Main Page.