Environmental Disclosures in Global Supply Chains

Environmental Disclosures in Global Supply Chains

June 14 | By Dean Sevin Yeltekin

Professor Christian Opp explains why plans to reduce CO2 emissions must account for foreign trade partners and environmental disclosures.

When it comes to confronting global warming, there is a crowded chess board of governments and firms striving to maximize profit and protect global trade while ensuring emissions targets are met. In ongoing work, “Environmental Disclosures in Global Supply Chains,” Professor Opp and his co-author, Xingtan Zhang (Associate Professor of Finance at the Cheung Kong Graduate School of Business in Beijing), take a closer look at the tools governments use to incentivize greener business practices internationally, making the argument that an optimal tax policy takes incentives for disclosures in foreign countries into account.

Below are four key takeaways from their research:

1) State-level policy must take a global view.

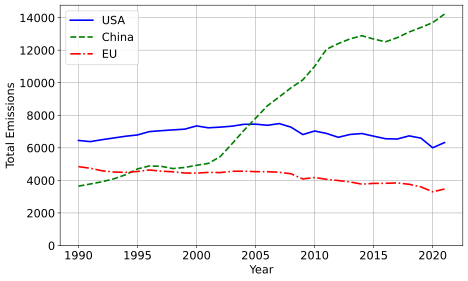

We would be hard-pressed to identify a more fully global policy problem than climate change—or a more complex one to solve. Professor Opp is from Germany, where most of the population is deeply concerned about the increasingly devastating effects of climate change, from displaced populations and political instability to food insecurity and poor air quality. But the countries that are most committed to environmental goals can only accomplish so much on their own when most pollution and emissions originate from activities outside their borders. The U.S., EU, and China are the top polluters in terms of carbon emissions (see Figure 1 below). When developing policy solutions, countries like Germany must start by recognizing that they are only one small piece of the puzzle. To have any chance of moving the needle in the right direction, they must pull their primary lever of influence: trade relationships.

This graph plots total emissions for the United States, China, and the EU as measured by megatons of carbon dioxide equivalent per year (Climate Action Tracker, 2023).

2) The impact of domestic policy hinges on environmental disclosures by foreign firms.

Many countries like Germany have focused on measuring and influencing the environmental footprint of their domestic firms. However, since production nowadays largely occurs in global supply chains, such efforts typically lead to a reliance on environmental disclosures from international trade partners. Depending on the rules and regulations in foreign countries, such disclosures may be largely voluntary and often far from transparent or reliable. As a result, measuring and influencing environmental standards is a far more complex task than it might seem at face value.

3) Foreign trade partners are incentivized to share information —but not everything.

Consider a firm like Apple that is producing iPads and iPhones in China. From sourcing the metal to assembling a final product, the process is energy intensive and leads to CO2 emissions. When negotiating supply chain contracts with Apple, foreign firms have a natural incentive to retain private information about their production practices—whether because of trade secrets or because it improves their bargaining position. However, at the same time, just like in the case of selling a used car, sellers also have incentives to provide some information because not doing so could jeopardize a transaction from occurring in the first place. Thus, foreign trade partners generally provide partial disclosures to their supply chain partners. Moreover, once governments enter the picture with rules and regulations that use those disclosures, this creates a feedback effect on firms’ strategic information sharing.

4) Standard tax approaches can backfire when environmental disclosures by foreign trade partners are voluntary.

A typical introductory macroeconomic course covers the Pigouvian tax concept, whereby a government should tax an activity like pollution at a level that is equal to the external costs that activity places on society. If a domestic firm’s sourcing from a foreign supply chain partner results in $1 billion worth of environmental damages, for example, then it would be taxed $1 billion under a Pigouvian tax. However, in the real world, a Pigouvian tax approach can backfire for several reasons. First, it fails to account for the feedback effect it creates on foreign firms’ disclosure incentives. If firms with brown production practices were penalized heavily, foreign firms’ disclosures would respond by becoming less informative. Yet imposing a Pigouvian tax itself requires accurate information about the environmental footprint of those producers, such as their CO2 emissions.

Second, domestic households benefit when well-established local firms can exercise market power in sourcing inputs internationally. This is because cost savings are passed on to domestic consumers. Yet this task is complicated by the fact that foreign firms have private information about their production practices and associated actual costs. A Pigouvian tax approach ignores these concerns and tends to overtax the sourcing of inputs, relative to an optimal approach. Instead of trying to impose a tax equal to the average damage caused by a foreign source, states are then better off imposing a tax that errs on the lower side.

It may seem like a counterintuitive regulatory approach, but when factoring in strategic environmental disclosures by foreign trade partners, less may be more.

Christian Opp is an associate professor of finance at Simon Business School. His work analyzes financial institutions’ and markets’ impact on allocations, with a particular focus on the role of informational frictions.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education. To view other blogs in this series, visit the Dean's Corner Main Page.