The American Rescue Plan

The American Rescue Plan Act:

A mixed bag

April 14, 2021 | By Dean Sevin Yeltekin

If last year’s CARES Act was designed to shield Americans from the economic onslaught of COVID-19, this year’s American Rescue Plan Act was intended to deal a lethal blow.

Did it succeed? It’s complicated.

Taking inventory.

Signed into law by President Joe Biden on March 11, 2021, the American Rescue Plan Act (ARP) funnels $1.9 trillion into the U.S. economy less than a year after the passage of the $2.2 trillion CARES Act.

In my last post, I referred to the CARES Act as a blunt instrument that provided relief to struggling households and businesses in the early days of the pandemic—one that was not especially nuanced or precise, but necessary and effective. A full year into the pandemic, the ARP is equally blunt, but with a different edge.

The $1.9 trillion package includes the following provisions:

State and Local Government Recovery Funds—State and local governments receive a combined total of $350 billion in two installments: the first half within 60 days and the second half a year later.

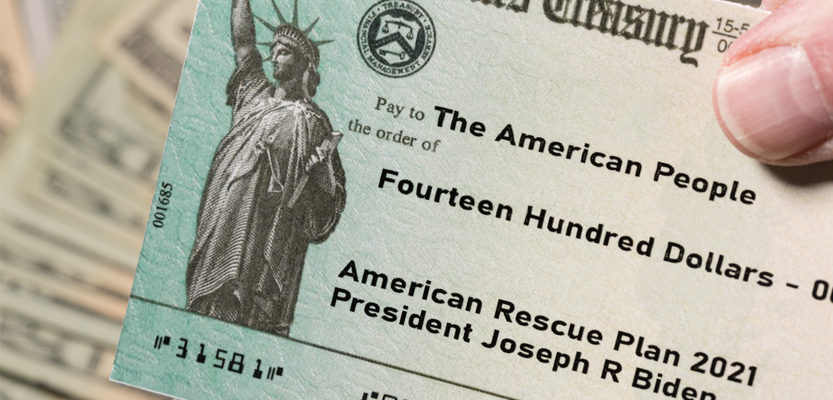

Economic Impact Payments—American households receive another round of direct payments: $1,400 for individuals, $2,800 for joint filers, and $1,400 for each qualifying dependent based on 2019 or 2020 tax returns. Payments phase out for individuals with an adjusted gross income of $75,000 ($112,500 for head of household and $150,000 married).

Expanded Unemployment Benefits—The Federal Pandemic Unemployment Compensation (FPUC) is extended through September 6, 2021, maintaining the FPUC benefit amount of $300.

Tax Relief—The ARP raises the maximum Earned Income Tax Credit (EITC) for adults without children from $543 to $1,502. It also increases the Child Tax Credit maximum amount to $3,000 per child and $3,600 for children under the age of 6, with a phase-out threshold of $75,000 ($112,500 for head of household and $150,000 married).

Emergency Education Relief—The Elementary and Secondary School Emergency Relief fund provides $122 billion for Pre-K-12 schools to reopen safely and compensate for learning losses during the pandemic.

Acknowledging the positives.

For households: ARP extends many of the most worthwhile provisions of the CARES Act. A third round of direct economic payments should theoretically fuel consumption, as the demographic that receives it (individuals making up to $75,000) is statistically more likely to spend than save. After a bruising financial year, extra cash on hand will act as a bandage to those who are struggling most.

For businesses: American businesses also stand to benefit from another round of Paycheck Protection Program (PPP) loans, particularly those in food, hospitality, and travel who are still in a holding pattern. The ARP creates a new group of “community navigators” to address the shortcomings of the CARES Act, which made it harder for small businesses without strong relationships with local financial institutions to access capital. The jury is still out on whether or not these inequities will persist, but the ARP takes a step in the right direction.

For state and local governments: The ARP will play a role in stabilizing operating budgets as state and local governments scramble to compensate for lost tax revenues as a result of the pandemic. Birmingham, Alabama, a city that relies heavily on sales tax and income tax revenue, experienced a $63 million shortfall in FY2021. The first half of the city’s $149 million ARP allocation will plug the hole. For cities and states that were forced to cut back on sanitary workers, planning personnel, and other government employees, the ARP should help return hiring levels to a pre-pandemic level.

Asking hard questions.

Judged through a more critical lens, the ARP doesn’t seem to know if it’s a stimulus plan or a long-term social safety net. Both possibilities raise hard questions.

If the ARP is a stimulus, why did it need to be so large?

The U.S. economy shrank by 3.5% in 2020, the largest drop since the Great Depression, but it was already rebounding by the second half of the year (record 33.4% growth in Q3 and 4% growth in Q4). With some economists predicting a full rebound to pre-pandemic levels by the end of Q1 2021, it’s unclear why the ARP injects another $1.9 trillion into the economy in the middle of this season of growth.

In an op-ed published recently in the Wall Street Journal, U.S. Senator Mitt Romney calls the ARP a “clunker” of a bill and points out the fact that 21 states actually experienced revenue increases in 2020. California, most notably, finished the year with a $15 billion surplus yet received $42 billion in ARP funding.

If the ARP is a stimulus plan, it’s more than a blunt instrument—it’s a heavy, unwieldy one that swings with more force than necessary.

Through another lens, though, the ARP is more geared toward building a long-term social safety net than it is toward stimulating the economy. The Congressional Budget Office found that more than a third of the proposed funding—$700 billion—will not be spent until 2022 at the earliest. State and local government that receive allocations from the ARP have until 2024 to spend the funds they receive.

If the ARP is a social safety net, how will it help schools return to normal?

The ARP’s Elementary and Secondary School Emergency Relief Fund makes a record investment in U.S. schools, but it’s unclear how an infusion of cash will help children return to the classroom. Parents, teachers, and educators are experiencing what is mostly a public health crisis, not a pure cash flow crisis. Public schools rely on property taxes for the majority of their funding, and property tax revenue has not declined during the pandemic.

We have yet to begin to vaccinate high school students or make a definitive plan for in-person versus hybrid learning in 2021. These are the issues that merit the most attention. While schools might appreciate having more cash on hand in the long-term, it’s hard to make the case that cash payments will send students back to school and parents back to the office any sooner.

Again, how are we going to pay for this?

Even before the ARP was signed into law, the Congressional Budget Office was projecting a federal budget deficit of $2.3 trillion in 2021, the second largest since 1945. Federal debt held by the public, which clocked in at 100% of GDP at the end of FY2020, is projected to reach 102% at the end of 2021. Public anxiety is already rising over what this level of debt will mean in practical terms—from spending cuts to tax hikes—and the ARP does little to assuage their concerns. My colleague David Primo wrote about his concerns regarding the ballooning debt in this blog just recently. With now a $2.0T infrastructure bill introduced by the Biden administration, debt and deficit alarms are starting to ring louder.

The final grade.

Like the CARES Act, the ARP has its points of pride. It provides a welcome boost to families who are just starting to see the light at the end of the financial tunnel but aren’t quite there yet. Industries struggling to maintain cash flow until they can resume their operations will also find a much-needed lifeline in the ARP. Likewise, state and local governments that have experienced a significant loss of tax revenue will find much to applaud about the ARP as they make plans to rehire laid-off workers and invest in economic development efforts.

Despite its unequivocally good intentions, the ARP is ultimately an oversized hammer that doesn’t quite know where or how hard to strike. It deserves two different grades: one as a stimulus and one as a social safety investment. In my 22 years as an educator, I have never been accused of being an easy grader, so armed with my red pen, here comes the final grade.

From the stimulus perspective, I give the ARP a B, like its older sister, CARES. It delivered necessary aid to households and businesses at the end of an economic nightmare, and it fixed some issues surrounding CARES, but this aid arrived when the economy was already stimulated.

From the social safety net perspective, I give the ARP a C. There’s no doubt that states and schools will find worthy uses for this funding, but giving injections of money without incentives or clearly defined goals is never an optimal strategy in designing social insurance or sustainable fiscal policy.

As our society transitions into a post-COVID economy, I suspect that we will look back at the American Rescue Plan as a flawed but useful tool, a financial weapon that struck a final blow in a battle that was already won.

Sevin Yeltekin, Dean

April 14, 2021