Tweaking the pricing algorithm

Tweaking the pricing algorithm

January 28, 2021 | By Yufeng Huang

If you have ever rented out a space on Airbnb, you know that determining an optimal price is easier said than done.

At Simon Business School, I spent a good portion of my time studying pricing frictions—a situation in which prices fail to react to changes in market conditions. These frictions provide one of the most compelling rationales for online tech platforms to adopt pricing algorithms. But while algorithms can certainly compensate for managerial inexperience, they aren’t always a reliable solution.

In a recent paper, I used detailed data on Airbnb prices and rental outcomes to illustrate the limitations of pricing algorithms and suggest a better way forward.

The price isn’t right.

Curious about what a deep dive into Airbnb pricing would reveal, I collected data from more than 18,000 rental listings operated by more than 12,800 Airbnb sellers—defined as people who rent out spaces—in San Francisco between 2015-20.

Like I expected, the data revealed major differences in pricing strategy among sellers.

On one end of the spectrum are professional managers who handle multiple listings at the same time, set flexible prices across nights, and change these prices frequently. I suspected these managers base their prices at least in part on Airbnb’s suggested “smart pricing” algorithm, which was rolled out in 2016 to help sellers optimize prices amid seasonal changes, special events, and other drivers of demand.

At the other end of the spectrum, I found amateur sellers renting out their own homes. In most cases, these sellers use simple pricing strategies that fail to account for fluctuations in demand. They may rent an apartment for $200 every day of the year, for example, even on a holiday weekend or when a major event is selling out nearby hotels.

There’s no question that many sellers need to bring in outside expertise when it comes to pricing strategy. But how much does this lack of expertise matter?

To find out, I built a model that characterizes all the different pricing decisions across different types of sellers, from the greenest amateurs to the most seasoned professionals.

Estimating the model with my data, I determined that pricing frictions—in this case, amateur sellers’ inability to track demand and market conditions—result in a 14% consumer welfare loss and up to 15% seller-profit loss, compared to the optimal pricing benchmark.

The pricing tips developed by Airbnb are largely geared toward helping these sellers develop more savvy strategies to avoid pricing frictions. Unfortunately, relying on an algorithm doesn’t reap rewards for every seller.

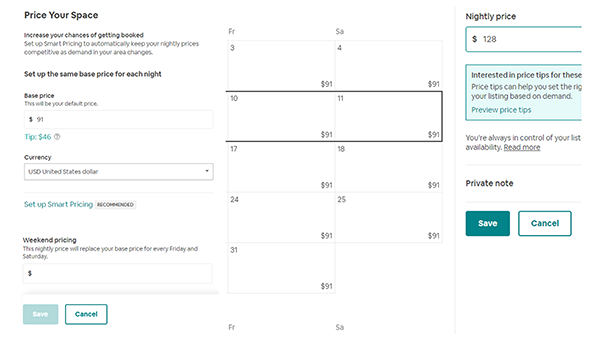

As a test case, I tried to rent out my own Rochester apartment on Airbnb. Off the bat, I was surprised by the complexity of the pricing interface. It was significantly more difficult to navigate than I expected.

I also encountered a lack of flexibility. For example, I could set a fixed everyday price or set a fixed weekend surcharge for my space. But beyond that, I could not easily set holiday or seasonal pricing, nor could I automate price changes to respond to changes in the local market. The absence of more advanced features contributes to the pricing frictions we see among Airbnb sellers.

A screenshot of the pricing interface on Airbnb

Pricing incentives.

While difficulties in pricing and the inflexible interface are certainly significant, I found that the greatest limitation of the Airbnb pricing algorithm has to do with incentives.

It comes down to this: The platform has different incentives than individual sellers. Airbnb has acknowledged that its algorithm is revenue-maximizing. Its earnings come from a fixed percentage fee from the total booking revenue, so maximizing revenue for each transaction also maximizes its own earnings. In other words, the platform will recommend a price that limits vacancy rates and maximizes overall revenue for Airbnb.

Sellers, on the other hand, are profit-maximizing. Renting out a room at $150/night for three nights per week would bring in more overall revenue than renting it out for $200/night for two nights, but the seller would rather maximize profit for each night to account for the hassle of hosting. After all, it’s the seller, not Airbnb, who spends time cleaning up after an unexpectedly messy guest or loses productivity because of noise interruptions. Sellers often find it in their best interest to set the price higher than the Airbnb algorithm, even if it means renting their space for fewer nights and pocketing less gross rental income overall.

A better design.

To address the mismatch between the Airbnb pricing algorithm and seller incentives, I set out to propose a more effective market design.

I used my pricing model to simulate different market designs. Going into the process, I knew that the Airbnb platform was good at understanding demand conditions, while the seller was good at factoring in their own costs of hosting, both tangible and intangible. My goal was to find a middle ground between a pricing model determined by the Airbnb algorithm and a model that is driven by individual sellers’ decisions.

One feasible improvement I discovered is a platform-assisted pricing design that leverages the strengths of the Airbnb algorithm while maintaining sellers’ control over pricing. In this model, Airbnb determines how prices will vary depending on demand and market conditions, but sellers set a base price and have the option to manually change the price if necessary. I found that this combination—letting the platform automate price variation but giving sellers the ability to input some parameters—is the key to setting optimal prices. According to my research, implementing my unique pricing model would completely eliminate pricing frictions for Airbnb sellers.

The bottom line.

When studying platforms like Airbnb, we have to remember that they are fundamentally different from traditional marketplaces where firms have professional managers. These platforms are typically free entry with millions of participants, many of whom have little to no pricing expertise. Whether it's Amazon, Airbnb, or Uber, dynamic pricing will only become more necessary and prevalent as time goes on.

But while pricing algorithms are useful, they can’t replace human judgment. They can’t get inside a seller’s mind and understand what that person’s time is worth to them, whether it’s spent preparing an apartment for a renter or driving their car for Uber. Just as some Airbnb renters only find it worthwhile to rent a room for a specific amount of profit, some Uber drivers only find it worth their time to drive if they reach a certain hourly wage, even if it means driving fewer hours overall. But like with Airbnb, the pricing algorithm currently used by the Uber platform has no way to account for differences in opportunity cost. There is clearly something missing here.

By designing pricing models that combine platform expertise with seller knowledge, we leverage the power of machine learning algorithms while using human discernment to create guardrails. In doing so, we can achieve the best of both worlds for sellers and the customers they serve. That’s the way of the future.

Yufeng Huang is an Assistant Professor of Marketing at Simon Business School.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education.